Life science companies face a unique challenge: communicating complex science and uncertain timelines to investors who need clear information to make decisions. During the seminar “Raising Capital in Life Science: What Investors Really Want to Know”, several expert investors shared their perspectives.

Sweeping claims don’t suffice

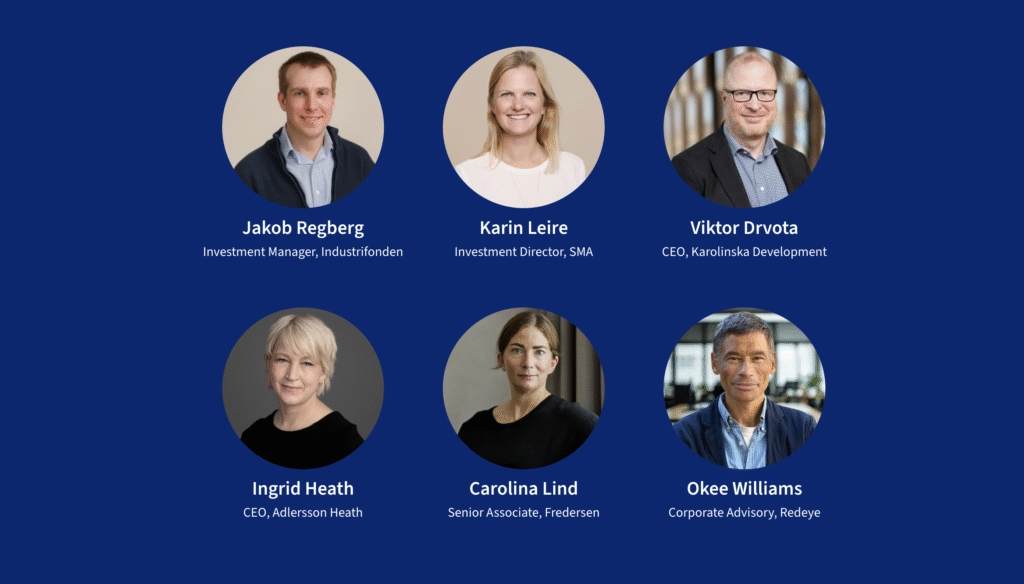

Viktor Drvota, CEO of Karolinska Development, focused on what investors often miss when they meet companies.

– The first thing we often miss is a detailed market analysis. What is the actual size of the market? Sometimes we only hear sweeping statements like “diabetes, it’s so big.” Well, that’s not what we want to know. Is this a first-line drug, second-line drug, third-line drug? What exactly is the number of patients you can treat?

– And more importantly, what is the price you can get for your drug? That’s where you get the market size. Pricing in the beginning is complicated, but you can look at reference pricing, especially in the US because the US market is super important. That’s where we see companies miss out.

Equally important is the question of acquisition potential, according to Viktor Drvota.

– The second thing is: we would like to exit this company sometime in the future. What are the market dynamics? Why should someone want to buy you and who wants to buy you? That’s something we look carefully into when we evaluate companies, he explained.

“It’s all about building relationships”

Karin Leire, Investment Director at Segula Medical, specialist investors in med-tech, emphasized the importance of relationships.

– At the end of the day, it’s all about building relationships, and for us as investors, it’s important to build trust with the party we are interacting with. Because there is no straight answer to what each investor wants; it will always be influenced by the experiences of that individual. Understand who you are talking with before you start talking about your company.

On specifics that investors look for, Karin explained:

– The first is regulatory strategy. Compared to the more straightforward route to market with drugs, there is room to be street smart with regulatory work. You can understand different classifications in different regulations and choose to enter the market with a product that has fewer claims, then build claims as the product is already in the market. This helps us evaluate if the company is street smart enough. You want to know they understand what they have in front of them.

The real challenges start when you have a product and are about to sell it, she emphasized.

– In med-tech, we don’t have the advantage of a standard of care that automatically changes when your product is approved. The journey essentially starts then. Evaluating regulatory strategy also encompasses evaluating the maturity of the people running the business. Do they know what they have in front of them?

– The second point is describing the market. It’s critical to ensure you’re on the same page as the investor. It’s not enough to know the total addressable market if you don’t understand the ability to actually change the standard of care, or whether clinical guidelines have already been influenced by your technology.

What’s your potential?

Jacob Reberg, Investment Manager at Industrifonden, approached the discussion from a therapeutics investor perspective. It’s quite common to meet a company that fails to explain what their product is, he explained:

– I’m not going to be interested in a company if they can’t explain what they’re working on. If they have a reason not to disclose it, they need to explain why and at least give some details about how it fits into the biology.

Related to this, IP is very important, he said:

– We don’t just want to know if there’s a patent, but what type it is, its expiry, and any strategies to extend it. This shouldn’t be saved for the last confidential presentation – it should be presented early.

His third point concerned the competitive landscape, which he described as usually lacking.

– We need to know that the company has considered how it fits in the treatment landscape, what competitors are doing, and what other researchers may be working on. Doing this analysis demonstrates understanding of your product and its potential market place. Many companies think about this but don’t always communicate it.

– Regarding the financing round, we usually hear something like: “We want 10 million to take this to phase 2B.” That’s fine, but more information on how the money will be used is helpful. What is spent on the trial, on CMC, or on product development if it’s a med-tech device? We have a good idea of what a clinical trial should cost, so if your budget is much higher than expected, it’s worth explaining.

– Finally, pre-money valuation is rarely in the deck. We always have to ask, as do other investors. It’s helpful to know the company’s idea of its value – not for an exact number, but to avoid a large mismatch between our valuation and the company’s.

Stick to verifiable facts in your communication

Carolina Lind, lawyer at Fredersen Law Firm and part of the financing group at SwedenBIO, talked about the legal framework surrounding investments, focusing on listed companies.

– For listed companies disclosure is strictly regulated. All potential investors must be able to rely on full and transparent disclosure in time to make informed decisions, she explained.

The EU Listing Act, effective December last year, harmonizes regulations to make EU capital markets more attractive, especially for SMEs. It amends both MAR and the Prospectus Regulation, Carolina explained:

– These rules provide a safe harbor for lawful disclosure of inside information, though requirements such as maintaining an insider list and trading bans still apply. All late information must be consistent with the most recently published information or disclosed promptly.

– Regulatory disclosure should not be combined with marketing – stick to verifiable facts and avoid promotional language. A gap analysis against the industry guidelines can streamline the process and ensure compliance with both regulatory and investor expectations, she concluded.

A simple framework for better communication

Ingrid Heath, chairperson of the finance working group and CEO of Adlersson Heath, explained the benefits of the new industry standard developed by the group.

– Life science is an industry with high capital needs and complexity. Transparent communication about potential and risk will earn the trust of investors, both in good times and in challenging times, she said, adding: “Communication needs to be coherent across this spectrum.”

The standard developed by SwedenBIO’s working group provides a simple framework. If everyone follows it, it sets a high baseline for investor communication. It’s structured so that what should be done at each stage becomes obvious. But, Ingrid cautioned – the standard is only valuable if it’s used:

– Companies and advisors can use it as a checklist for strategy meetings, business planning, and pitch deck preparation. It ensures all necessary information is covered, saving time and providing investors with what they need to start their analysis. Early adoption offers a competitive advantage, she concluded.

You can watch the entire seminar here.